At Quilvest Capital Partners, we firmly believe that as a leading financial institution, we bear a responsibility towards society in effectively and responsibly managing our investment activities' environmental and social impacts. Sustainability has consistently been integral to our firm, driven by the Quilvest family shareholding structure and DNA. As long-term investors, we aim to foster sustainable growth and value. Incorporating sustainability criteria into our decision-making process contributes to long-term returns and plays a significant role in preserving wealth.

"Sustainability has always been at the heart of Quilvest Capital Partners’ culture and philosophy. Beyond being a key priority for us as a community, we deeply believe in the double bottom-line effect that will drive the performance of our portfolio and create value for our investors."

Alexis Meffre

Chief Executive Officer, Quilvest Capital Partners

Quilvest Capital Partners' Responsible Investment Policy

This policy, updated in July 2025, goes beyond legal and compliance conformity; it sets both our commitment to sustainability and our approach to responsible investment, with the primary objective being the support of our people in performing their work and decision-making.

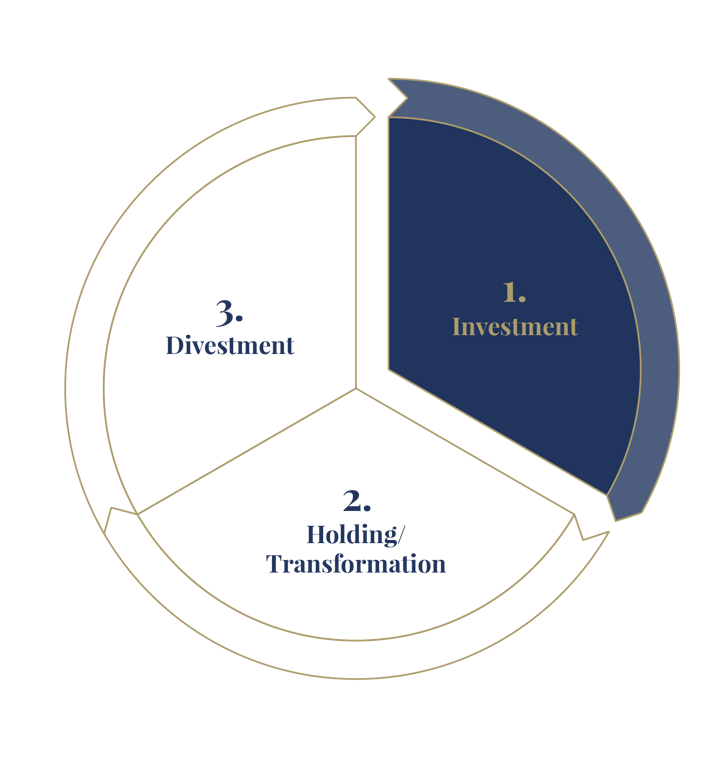

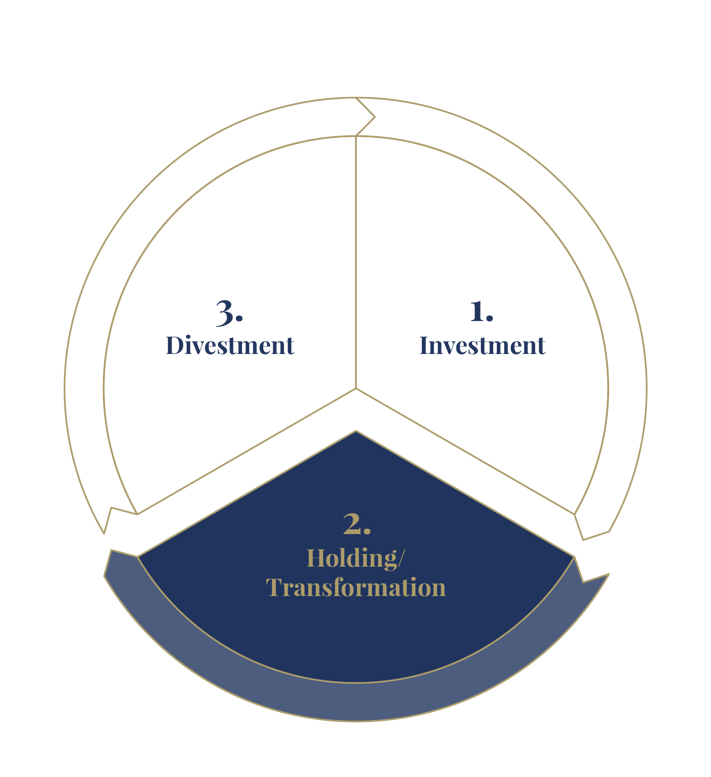

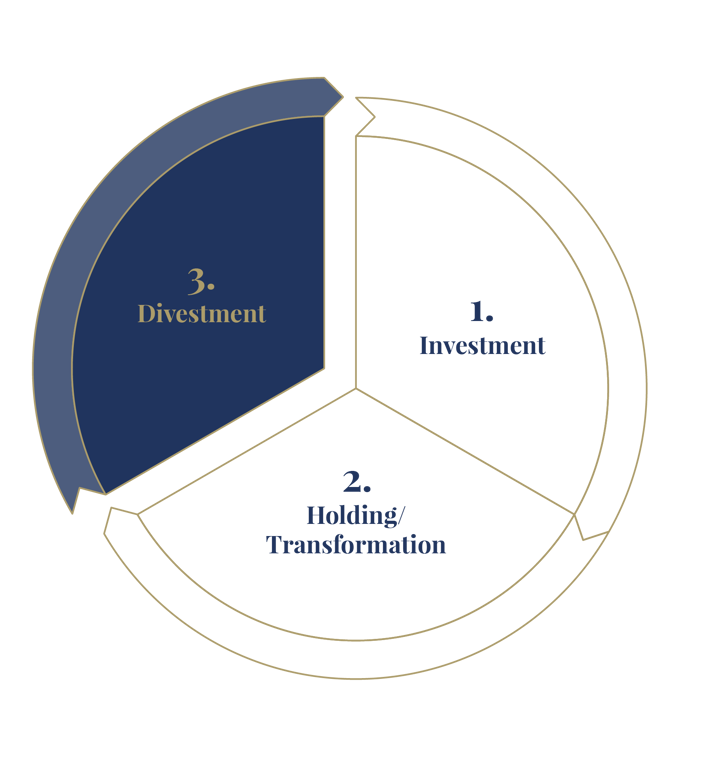

Investment Process

We incorporate responsible investing at every stage of our investment process:

Before the investment

- Our funds’ commitments follow Quilvest’s sustainability policy and roadmap.

- We screen each investment according to the Quilvest exclusion list.

- We conduct internal sustainability analysis using our proprietary due diligence questionnaire developed with Deloitte to assess potential risks and opportunities related to the environment, society, and governance. For private equity investments, an external provider specialized in the asset’s characteristics (geography, sector, etc.) systematically conducts a dedicated due diligence report, which the Investment Committee considers.

During the investment

- We define an impact action plan tailored to the investment, to be discussed frequently at Boardan impact action plan tailored to the investment with the management of our portfolio companies, to be discussed frequently at the Board level.

- We integrate impact targets into the incentivisation plans of our management teams within the portfolio.

- We work with operating partners of our real estate properties to achieve impact related to KPIs, in particular around local sourcing, energy and water.

- We monitor impact KPIs over the lifetime of the investment.

After the investment

- We support the asset during the exit process, notably by highlighting in the vendor documentation the progress made on sustainability topics during the holding period.

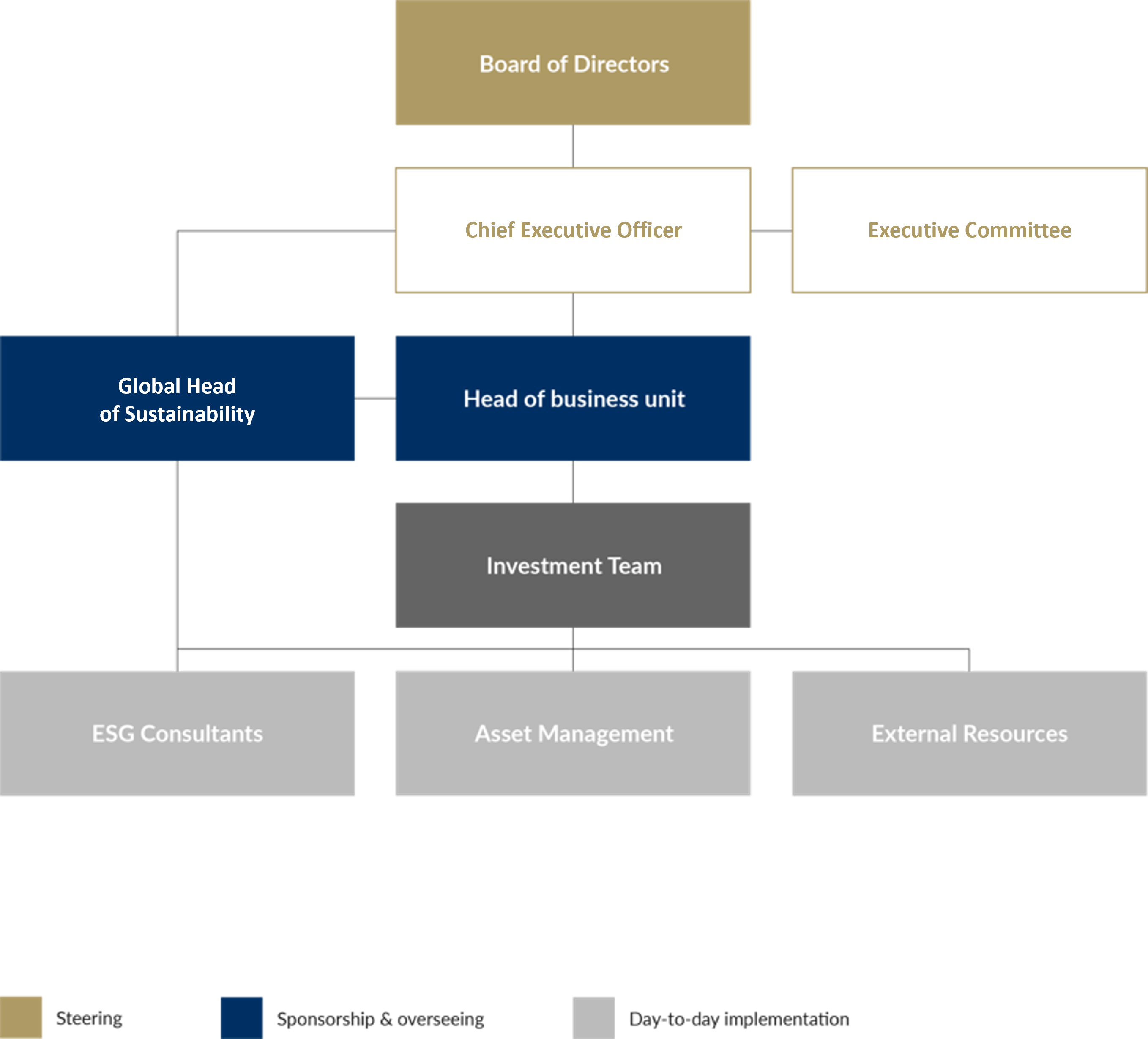

Our Sustainability Governance

Responsible investment at all levels of Quilvest Capital Partners’ organization.

Since 2019, the definition of our responsible investment strategy and its implementation are directly under the supervision of our Board of Directors to ensure that it is not just an operational focus but also a governance priority.

SFDR Disclosures

For all SFDR disclosures related to funds managed by Quilvest Capital Partners AM, please see the following page: AIFM